Market Forecasting

We make use of advanced Deep Learning and Machine Learning techniques combined with Quantitative Analytic methods to find correlations and patterns in data that can indicate directions and trends in financial markets.

Investment strategies are produced using sophisticated algorithms developed through our continuous research. No investment strategy lasts forever and so our models must be continually reviewed and tweaked to incorporate new signals that emerge.

Backtesting

We backtest our strategies and use several market indices as a benchmark to calculate the alpha our strategies are gauged on. We also measure the beta coefficient of our strategies to test their response to swings in the market.

Proprietary Algorithms

We have created proprietary algorithms that work to create strategies that would otherwise have been overlooked or missed entirely by a team of analysts as they provide biologically inspired intelligence combined with the speed and accuracy of a machine.

Data Variety

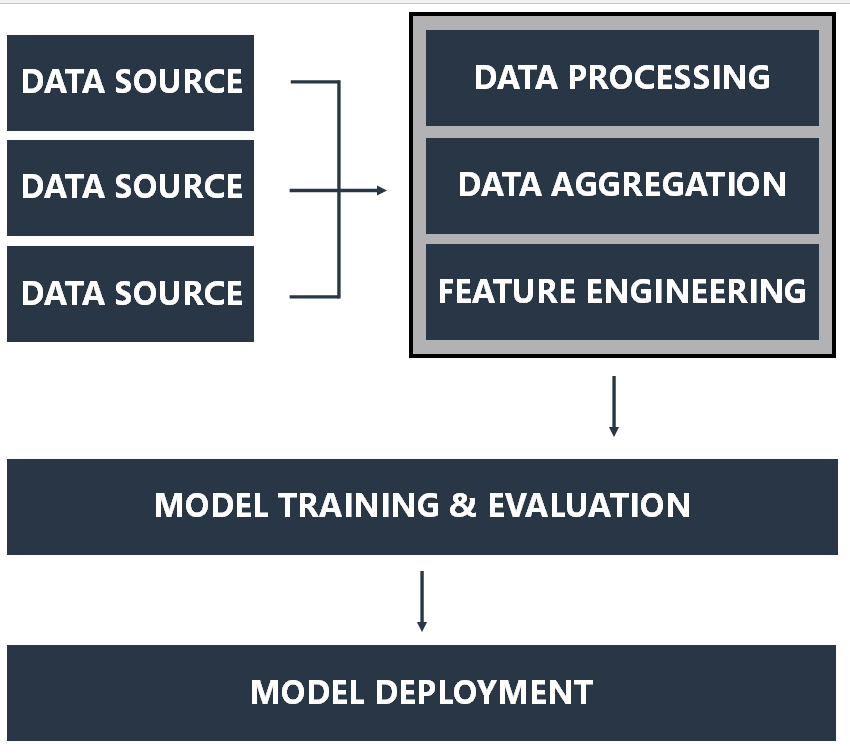

The markets are constantly influenced by world events. That is why we not only use financial data to create our models but also data sets on a variety of topics. In this way we are able to expose ourselves to the potential patterns that may occur outside of the traditional financial data sets as well.

Real Time Analytics

The markets move in real time so why shouldn't the analytics move in real time too? Advanced analytics for financial markets need to produce time critical insights so our models take in data continuously for up to date analysis and precision.

|

Identify Hidden SignalsThe main aim of our Market Forecasting Solutions is to locate signals that are hidden in the vast amounts of data we process in relation to the financial markets. |

|

Data Agregation & CleansingA large part of creating accurate machine learning predictions for any type of project is aggregating the data and making sure that it has been cleansed correctly. |

|

Portfolio BuildingOur models can help to produce balanced portfolios based on forecasted trends and observed patterns. |

|

Sentiment AnalysisOur models are created through a hybrid of algorithms that target different areas of data science. One area we monitor is the sentiment surrounding the market. |

|

Continuous ImprovementNo model can work forever and so we continually review and improve our approach so as to find new patterns to exploit inefficiencies in the market. |

|

Interactive DataThe models we create and linked to custom investment management platforms to allow for full exploration of the data behind the investment suggestions of the model. In that way full transparency and confidence can be achieved before investing. |